The 2024 Specialty Excellence Report is now available.

Following a summer of declines in new cases, deaths, and hospitalizations, the pandemic is finally over. Or is it? Epidemic or not, COVID’s enduring impact on the healthcare system is undeniable.

Despite these encouraging developments, the challenges facing U.S. hospitals continue to mount. Critical labor and supply shortages, rising patient acuity levels, and shifts towards outpatient care jeopardize hospitals’ ability to ensure care delivery in key specialties and regions. Hospitals are now tasked with managing COVID-based disruptions, scaling up and expanding ambulatory care services, supporting virtual care delivery channels, and mitigating the risk of economic hardship–all while striving to provide the best care possible.

The 2023 Healthgrades Specialty Excellence Report dives into the current and future trends impacting the healthcare industry, how organizations are shifting strategies to meet these new priorities, and what widespread variability in care means for hospitals and patients.

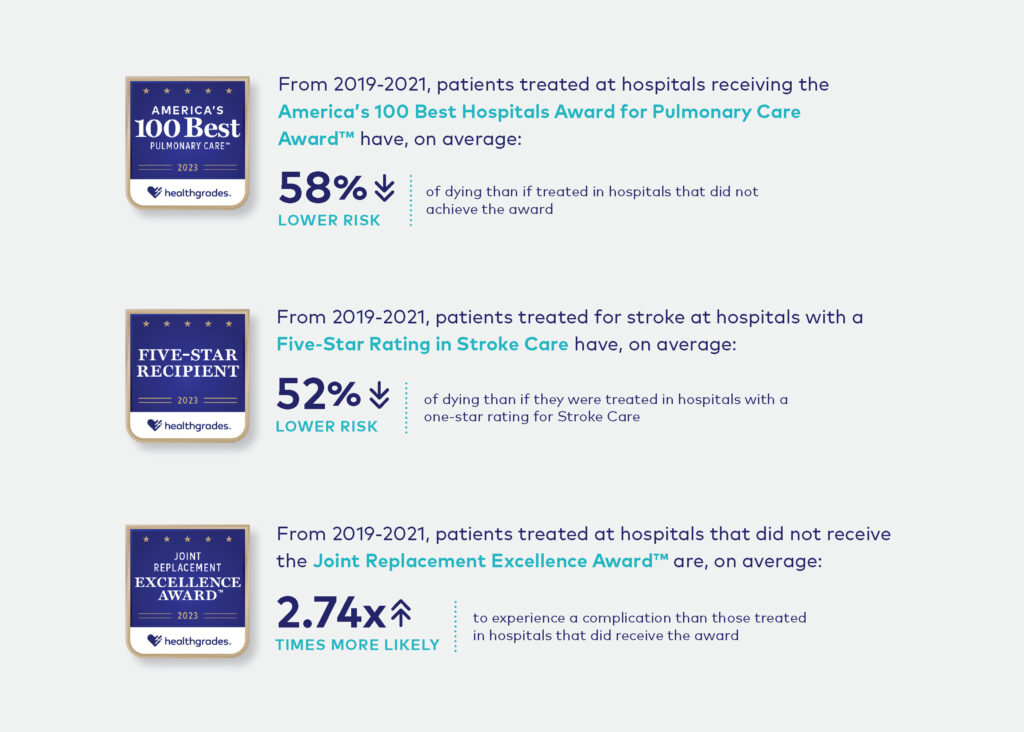

Healthgrades published this report in conjunction with the release of the 2023 Healthgrades Specialty Excellence Awards™ and Ratings, an annual occasion to recognize the nation’s top performers in specialty care, help patients find a hospital that excels in their condition or procedure, and empower hospitals with an actionable roadmap to solidifying and improving key service lines. Each fall, Healthgrades analyzes the risk-adjusted mortality and complication rates for 33 common procedures and conditions at nearly 4,500 hospitals to identify the nation’s top-performing hospitals for specialty care:

- Five-Star Ratings recipients – the top 15%

- Specialty Excellence Award recipients – the top 10%

- America’s 100 Best Hospitals for Specialty Care Award™ recipients – the top 2%

See the full list of 2023 specialty care awards and ratings recipients or learn more about how you can promote your hospital’s achievements.

Healthgrades Fall Ratings insights and Consumer Confidence Study Findings

Access to transparent insights on hospital performance has never been more valuable to today’s increasingly quality-conscious consumers. Our ongoing consumer confidence study indicates that while most U.S. adults are comfortable resuming everyday activities, quality remains top-of-mind for the majority of consumers.

According to our October 2022 study, 57% of patients report being more concerned with the quality of care provided by the doctors and hospitals they choose today than they were before the pandemic.1 Mirroring this concern, 64% say they are now more concerned with their health and wellness, and over one-third spend more time researching hospital quality before choosing where to have a procedure than they did pre-pandemic. And while over three-quarters–77%–say they would be comfortable visiting the hospital where they are most likely to go for a medical procedure, most U.S. adults do not believe the pandemic is over and are concerned about how the virus might impact themselves or their families in the next year.

As more consumers spend time researching hospitals before making a decision about where to seek care, it is imperative that they have the tools they need to easily identify the leading care options in their options. When patients seek care from a hospital with specialty care distinctions from Healthgrades, they can feel confident that they are minimizing their chances of experiencing a negative outcome.

In fact, based on our Fall Ratings analysis*:

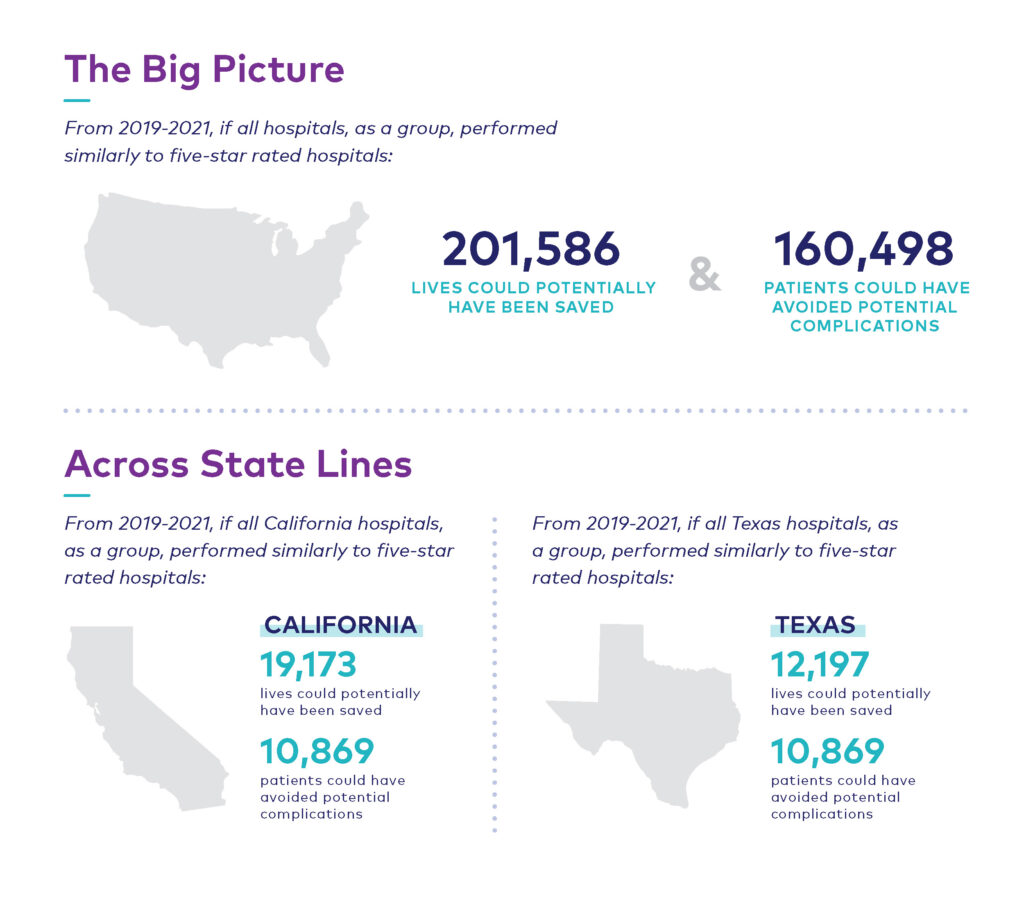

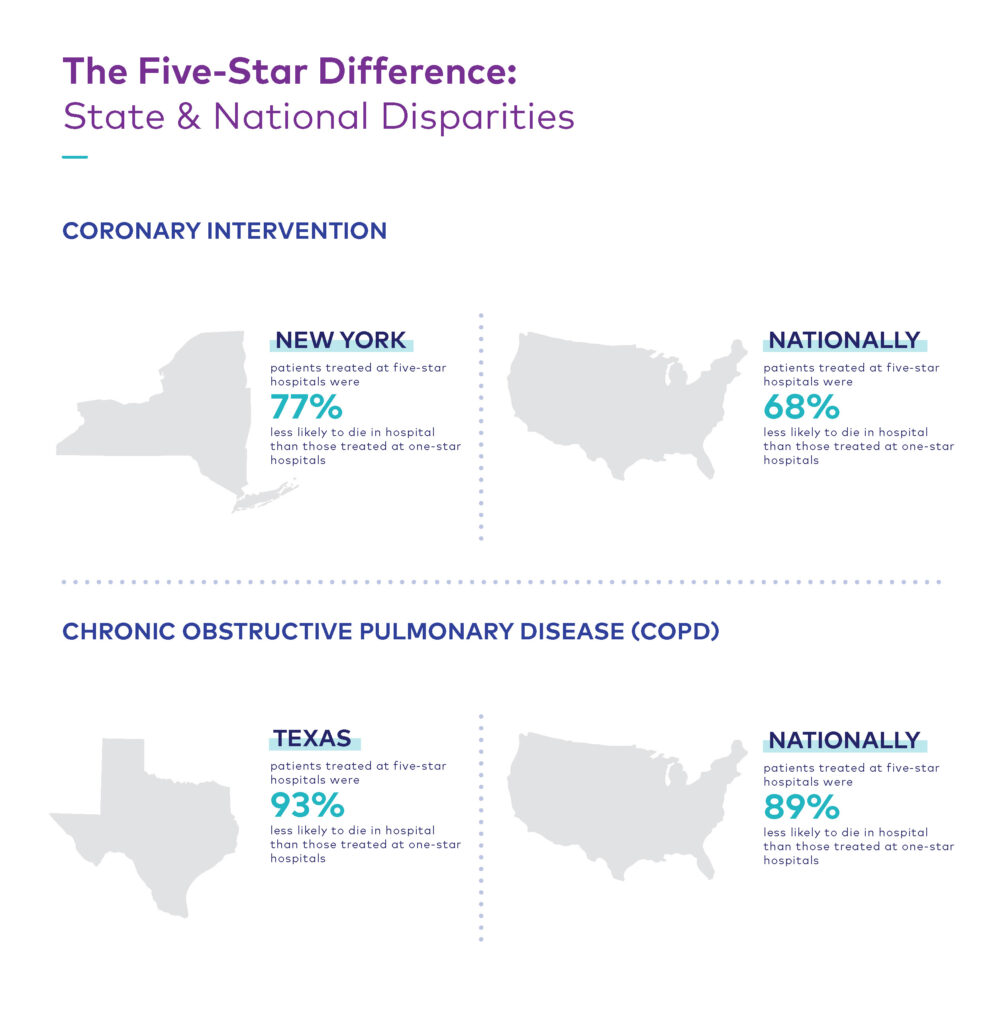

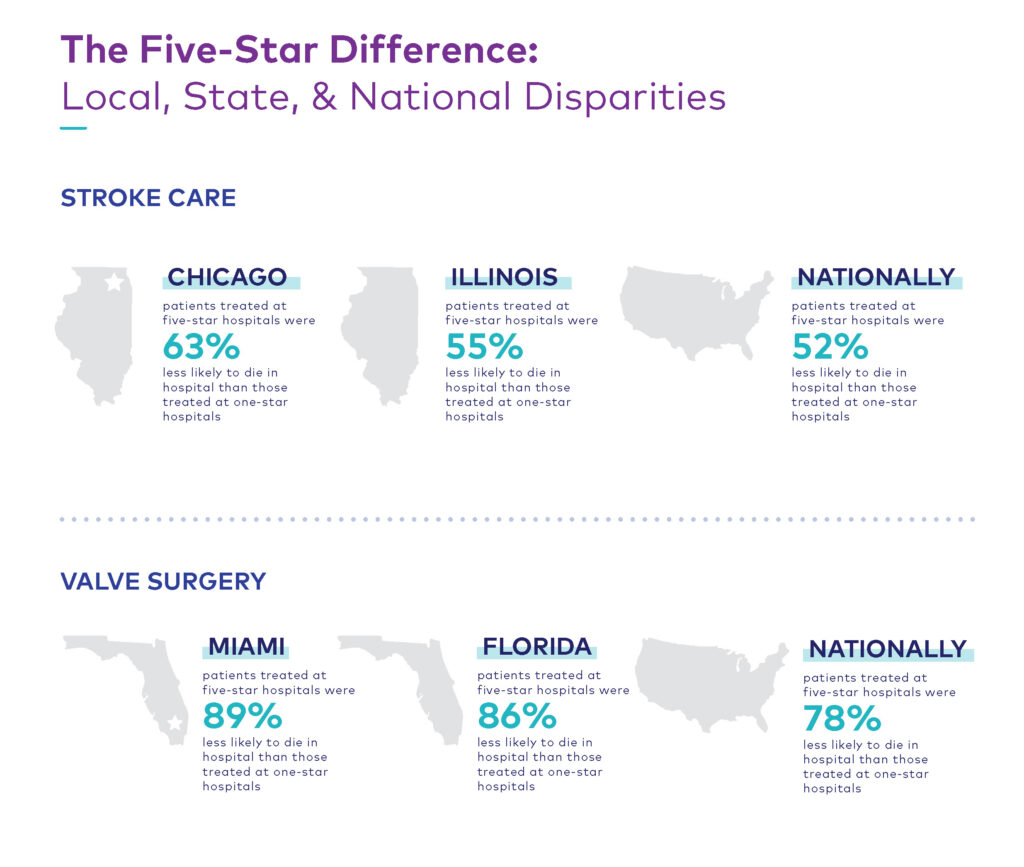

While it is important to recognize and celebrate this year’s awards recipients, our analysis highlights persistent, growing disparities in hospital performance at every level. These findings speak to the importance of helping consumers identify the best care solutions for their needs, and informing hospitals about their clinical strengths, weaknesses, and opportunities to improve. Both aspects are vital to improving patient outcomes, especially as the gap between the nation’s five- and one-star hospitals continues to widen not just nationally, but also from state-to-state and even within the same community*:

Staffing shortages, changes in care delivery, and the ongoing impacts of COVID have been major contributors to increasing variability in care and compromise hospitals’ efforts to improve patient outcomes. The following sections explore the causes of these three pain points and provide recommendations on how hospitals can meet these challenges while maintaining a high standard of care.

1. Critical labor shortages

Hospitals are facing significant financial headwinds in their efforts to get day-to-day operations back to their pre-pandemic levels, and the opportunities to recoup losses are few and far between. As a result, more than half of U.S. hospitals are expected to have negative margins through 2022, with year-end expenses projected to exceed 2021 levels by nearly $135 billion. Over half of this increase–$86 billion–is driven by inflated labor costs, and it is a burden that is only expected to worsen.

With an aging workforce, widespread employee burnout, and other COVID-related pressures, the U.S. is projected to take on a clinical workforce deficit of over 200,000-450,000 registered nurses and 50,000 physicians in the next three years. Facing unsustainable contract labor costs, hospitals are moving away from the use of travel nurses and investing in long-term recruitment and retention solutions. Many hospitals are demonstrating their commitment to staff through direct pay increase: a recent survey of hospital executives found that 98% of respondents had raised starting salaries or minimum wage, with wage increases exceeding for clinical staff at two-thirds of surveyed hospitals. Other compensation-based contingency plans include starting and retention bonuses, student loan forgiveness programs, and subsidies for childcare and commuting.

Some hospitals have implemented long-term retention and recruitment strategies aimed at improving overall company culture. After learning that nearly a quarter of the nation’s nurses planned to leave the profession within six months, HCA Houston Healthcare launched a series of initiatives aimed at improving employee well-being. These efforts include zen lounges, yoga sessions, weekly “wellness wagon” deliveries, and most recently, uninterrupted lunch breaks.

Hospitals successfully navigating current and future labor supply issues are focusing on investments in their teams, providing more staff coaching and mentoring programs, and looking to gain efficiencies powered by healthcare tech-enablement and the delegation of non-clinical tasks to non-clinical staff.

2. The evolving nature of care delivery

Although demand for outpatient care largely stabilized following omicron’s peak in early 2022, overall trends indicate that when it comes to surgical procedures, in-patient volumes have yet to return to pre-pandemic levels. Tracking with changes in consumer preferences, care delivery in non-acute settings has become the fastest growing business for hospitals, with revenue shares for home and ambulatory care facilities to increase by 1-2% each year.

Rapid growth in the non-acute care sector presents traditional care facilities with a unique opportunity to reduce care costs while tapping into new revenue streams, but in order to do so, hospitals must invest in new care pathways that provide patients with the services they need and the convenience they have come to expect from an increasingly consumer-centric industry. Fortunately, virtual appointments, telehealth support, ambulatory and outpatient surgical service expansions, and home care options are all part of an ever-expanding digital health industry that consumers are increasingly amenable to.

3. The impact of COVID on patient acuity

Without regular reporting from state and local agencies, it has become virtually impossible to capture the current scope and severity of the pandemic. Declines in positive test numbers and hospitalizations no longer tell the full story: early estimates suggest that upwards of 20% of U.S. adults who caught COVID over the summer are currently battling long COVID.

In addition to a rising volume of long COVID cases, delays in care fueled a near-10% increase in patient acuity between 2019 and 2021 that has further exacerbated the burden of labor and resource constraints on the nation’s hospitals. By the end of 2020, 56% of primary care physicians reported observing an increase in negative health outcomes due to deferment or inaccessible care. Average length of stay (ALOS) increases among both COVID and non-COVID patients mean that hospitals are caring for sicker patients who require more specialized treatment solutions and are less likely to recover. For hospitals, this necessitates hiring more critical staff, prescribing more specialty drugs, and acquiring more intensive supplies–all of which tend to come at a premium.

As part of their patient engagement efforts, hospitals must underscore the importance of disease management and preventative care to mitigate the effects of COVID on those with chronic conditions and support the overall prevention, identification, and containment of future outbreaks.

Data enhancements are coming to Healthgrades

Since 2021, Healthgrades has been studying the broader effects of COVID on patient outcomes across key service lines with the aim to understand and appropriately apply any risk adjustments needed for patients with a history of COVID or long COVID. Our initial analysis revealed statistically significant increases in negative outcomes among patients with a history of COVID in two areas of care: pneumonia and total hip replacement.

Healthgrades found that among patients being treated for pneumonia, those with a history of COVID are 23.5% more likely to die while in the hospital than patients who did not have a history of COVID. Similarly, patients with a history of COVID are 50% more likely to experience a complication while undergoing total hip replacement than those without. Healthgrades plans to incorporate these findings and more into future assessment models in order to better support hospitals in their ongoing efforts to combat the long-term impacts of the virus.

And a new risk adjustment for COVID is not the only enhancement on the horizon for Healthgrades: we are in the process of expanding our data sets and care analysis to incorporate outpatient information. As the migration to non-acute care settings continues, Healthgrades is actively working to ensure that consumers and doctors have the resources they need to inform their care choices and care delivery.

Healthgrades commends this year’s Specialty Excellence Award and Five-Star Ratings recipients for their extraordinary efforts to meet the healthcare needs of their communities in the face of these ongoing challenges.

From ratings and awards to clinician-led improvement strategies, Healthgrades Quality Solutions offer hospitals an actionable roadmap to addressing the competing crises outlined above. Contact us today to learn how partnering with Healthgrades can help your hospital differentiate the outstanding quality of your care services and achieve better outcomes.

A note on our methodology

Healthgrades awards and ratings are not a popularity contest: we do not consider a hospital’s reputation or financial standing when evaluating performance, and hospitals cannot opt-in or opt-out of the assessment process, allowing hospitals and consumers to stay focused on what matters most: patient outcomes. This is central to our mission to empower consumers with the resources they need to make informed decisions about where to get quality care. For more information on how Healthgrades rates hospitals, see our complete Healthgrades 2023 Specialty Excellence Methodology. A consumer-friendly overview of our methodology is available here.

1 Consumer Insights Survey, Infosurv on behalf of Healthgrades, n=991, October 2022.

*Statistics are based on Healthgrades analysis of MedPAR data for the years 2019 through 2021 and represent three-year estimates for Medicare patients only.