Following one of the industry’s most financially devastating years on record, hospitals nationwide continue to face pandemic-driven challenges that compromise their ability to deliver high quality care. Ongoing workforce shortages and unprecedented cost increases jeopardize day-to-day operations and undermine organizations’ ability to respond to recent rises in patient acuity while maintaining financial stability.

The 2024 Healthgrades Specialty Excellence Report explores the trends currently impacting the healthcare industry, what they mean for the future of care delivery, how organizations adapt to meet new demand, and what the growing variability in high quality care means for hospitals and patients.

Healthgrades published this report in conjunction with the release of the 2024 Healthgrades Specialty Excellence Awards™ and Ratings, an annual occasion recognizing the nation’s top performers in specialty care. Healthgrades analyzes the risk-adjusted mortality and complication rates at approximately 4,500 hospitals every fall to identify organizations that deliver consistently exceptional outcomes in 31 key procedures and conditions. Healthgrades recognizes excellence in specialty care with five-star ratings and three awards:

- Healthgrades Specialty Excellence Award™ – the top 10% of hospitals in 16 specialties

- America’s 100 Best Hospitals Award™ – the top 100 hospitals in 11 specialties

- America’s 50 Best Hospitals™ – the highest achievement recognizes the top 50 hospitals in three specialties

Click here to see the complete list of 2024 specialty care awards and ratings recipients.

Healthgrades Fall Ratings & Consumer Survey Insights

Access to objective hospital performance measures has never been more valuable to the increasingly quality-conscious consumer. Healthgrades’ consumer confidence study found that 57% of patients are more concerned with the quality of care they choose today than they were before the pandemic.1 Due to this heightened awareness, over one-third of patients say they spend more time researching hospital quality before choosing where to have a procedure than they did pre-pandemic.

As more consumers spend time researching hospitals before deciding where to seek care, they must have the tools they need to identify the highest quality care options easily. When patients seek care from a hospital with specialty care distinctions from Healthgrades, they can feel confident that they are minimizing their chances of experiencing a negative outcome.

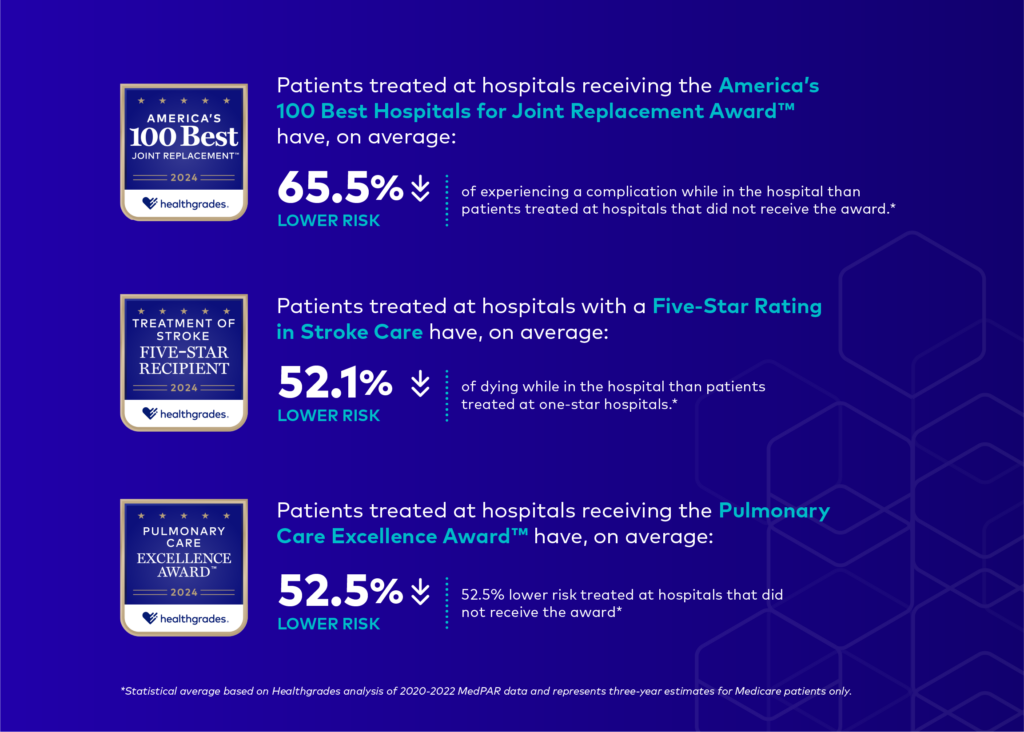

In fact, based on our Fall Ratings analysis*:

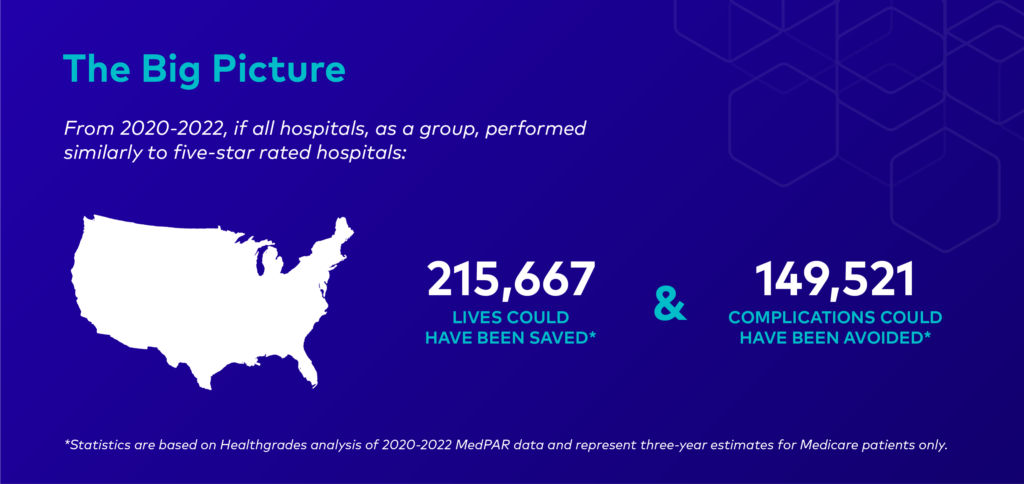

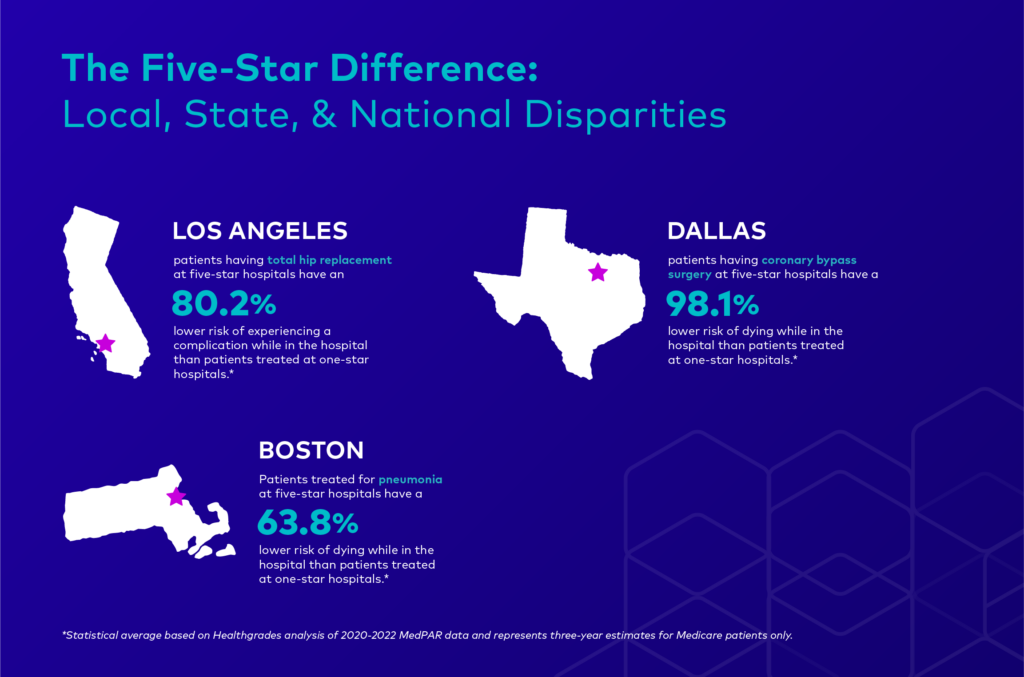

While it is important to recognize and celebrate this year’s award recipients, our analysis highlights persistent, growing disparities in hospital performance at every level. These findings speak to the importance of helping consumers identify the best care solutions for their needs and informing hospitals about their clinical strengths, weaknesses, and opportunities to improve. Both aspects are vital to improving patient outcomes, especially as the gap between the nation’s five- and one-star hospitals continues to widen not just nationally but even within the same community:

COVID-related disruptions continue to fuel variability in care and undermine the industry’s efforts to improve patient outcomes. The following sections explore how skyrocketing expenditures, ongoing labor shortages, and rising patient acuity impact the nation’s hospitals and offer recommendations on how hospitals can meet these challenges while maintaining a high standard of care.

Inflationary Pressures & Patient Acuity Are on the Rise

Hospitals are facing significant financial headwinds in their efforts to get day-to-day operations back to their pre-pandemic levels. 2022 proved to be one of the most financially devastating years for the healthcare industry in decades, with nearly half of the nation’s hospitals ending the year with negative operating margins. Historic inflation has left the nation’s hospitals with few opportunities to recoup these losses in 2023 as demand for care remains high.

While COVID-19 is no longer consumers’ primary reason for care deferment, a growing number of Americans are postponing care due to cost. Over one-fourth of consumers reported skipping some form of care last year due to costs, a 4% increase since 2021. Cost concerns impacted women and LGBTQ+ communities disproportionately, with 33% and 43%, respectively, reporting they’d delayed care in the last year for this reason. Cost-related deferments can result in delayed diagnosis, which contributes to higher acuity levels and treatment costs for hospitals. Patient acuity is projected to increase by another 10% over the next decade, reflecting an increase in case mix and longer hospital stays.

As a result of higher acuity patients and labor shortages in post-acute care facilities, hospitals face additional costs associated with delays in discharges and longer inpatient stays. Increases in the average length of stay (ALOS) mean that hospitals care for sicker patients who require more specialized treatment solutions and are less likely to recover. For hospitals, this necessitates hiring more critical staff, prescribing more specialty drugs, and acquiring more intensive supplies–all of which tend to come at a premium. Even when accounting for higher patient acuity levels, the ALOS for patients being discharged to post-acute care settings grew by over 19% between 2019 and 2022. Hospitals are not adequately reimbursed for the care they provide to these patients while they await discharge, creating costly bottlenecks for hospitals as inpatient care costs soar.

Overall, treatment costs per patient are up 22.5% since the start of the pandemic, driven mainly by skyrocketing contract labor costs. According to the American Hospital Association, total contract labor expenditures increased over 250% between 2019 and 2022 as hospitals relied on staffing agencies to fill crucial workforce gaps. The largest share of total contract hours went toward nursing, one of the industry’s most chronically understaffed departments.

Critical Nursing Shortages

A growing share of nurses’ workloads are spent on administrative tasks due to spending reviews, non-clinical staffing cuts, and the aftershocks of COVID-19. The majority of nurses (60%) reported an increase in their workload during the pandemic, fueling widespread feelings of burnout and moral distress. Unmanageable workloads are a key driver behind the growing nursing shortage, estimated to reach 200,000 to 450,000 vacancies by 2025.

Hospitals must invest in solutions that prioritize direct patient care and reduce non-nursing task loads to retain their nursing workforces and maintain optimal nurse-to-patient ratios. A recent study from McKinsey suggests that technology or an optimized care model could save up to 30% of a nurse’s 12-hour shift. For example, researchers estimate that delegating activities like transfers, IVs, and drawing labs to technicians or other support staff could free up to 10% of a nurse’s shift. In addition to delegation, hospitals can leverage their existing teams through centralized training and upskilling. While not enough to close the gap, even 15% of reallocated time could support closing the workforce gap by 300,000 inpatient nurses.

Hospitals can further ensure that nurses are working at the top of their licenses by identifying tasks that AI can perform and assessing current technologies for possible redundancies or rework. While investing in AI may be cost-prohibitive for some organizations, the long-term benefits are considerable. Beyond better patient care, the wider adoption of AI could save the industry up to $360 billion annually. With funding increases slated for 2024, hospital leadership seems eager to tap into the benefits of incremental AI.

Hospitals are turning to new technology to improve and maintain operations as the staffing crisis persists. One North Carolina health system has saved $5.4 million annually since implementing a retention dashboard that allows leadership to track workforce trends and streamline administrative workloads. With greater alignment between the C-suite and frontline care workers, the organization has seen a 20% drop in nurse turnover within the last four years. Hospitals are also exploring using generative AI in direct care settings to reduce administrative burdens. The Nabla Copliot, a recently deployed medical scribe, can record an entire patient-physician conversation and compose an EHR-integrated clinical record in under 20 seconds. The tool, which requires no training, reportedly saves physicians 1.5 hours a day.

The Future of Nursing

Declines in the nursing workforce are so severe that the nation’s nursing schools struggle to keep up. The American Association of Colleges of Nursing (AACN) reported its first decrease in enrollment in 20 years after nursing schools turned away nearly 80,000 qualified applications in 2022. The AACN cites faculty shortages as a leading factor behind declining enrollment: academic institutions cannot offer a competitive salary to recruit practicing nurses, and few nurses with advanced degrees are willing to make the switch. There are fewer opportunities for clinical rotations as hospitals contend with their own staffing shortages and lack qualified staff to supervise and train students.

Robust public and private partnerships are required to train the next generation of nurses and close the growing workforce gap. At the federal level, the Health Resources and Services Administration recently dedicated $100 million to nursing training, with $26.5 million in low-interest loans and loan cancellation to attract nurses to faculty positions. Meanwhile, health systems nationwide are partnering with academic institutions to address faculty shortages and boost admission rates. An ongoing partnership with a Pennsylvania health system allowed a nearby nursing college to increase admission rates and hire more full-time faculty and clinical instructors. The health system can accommodate a rapidly growing student population while incentivizing its own nurses to pursue advanced degrees and join the faculty.

The nursing deficit represents a new global health crisis with no end in sight. As of May 2023, 45% of inpatient nurses indicate that they are likely to leave their role within the next six months. Adverse patient outcomes are inextricably linked to higher case burdens: for each additional patient a nurse is assigned, the likelihood of a patient dying increases by 7%. It comes as little surprise, therefore, that a declining share of nurses are satisfied with the quality of the care they provide today than at the height of the pandemic.

To support high-demand clinicians in their efforts to improve patient outcomes, Healthgrades introduced the Quality Insights Platform, a highly customizable series of self-service, EHR-compatible clinical dashboards. The Quality Insights Platform allows busy care teams to track performance in key service areas over time, benchmark their clinical outcomes against top performers, and view outcomes in physician- and patient-level detail. By enabling the early detection of potentially preventable adverse outcomes, Healthgrades’ latest offering puts hospitals on an accelerated path to sustained quality improvement without contributing to clinicians’ administrative burdens.

In light of these ongoing challenges, Healthgrades commends this year’s Specialty Excellence and Five-Star Ratings recipients for their extraordinary efforts to meet the healthcare needs of their communities.

A Note on Our Methodology

Healthgrades awards and ratings are not a popularity contest: we do not consider a hospital’s reputation or financial standing when evaluating performance, and hospitals cannot opt-in or opt-out of the assessment process, allowing hospitals and consumers to stay focused on what matters most: patient outcomes. Ensuring that all patients have access to data-driven measures of hospital quality is central to our mission to help consumers make informed decisions about where to seek care.

As consumer preference for outpatient care continues to grow, Healthgrades is working to expand our patent pending outpatient methodology to help patients find award-winning orthopedic care in hospital-owned outpatient facilities. In May 2023, Healthgrades released the nation’s first outpatient quality metrics based solely on clinical outcomes. These first-of-a-kind, outcomes-based outpatient metrics are a critically important resource for consumers navigating one of the fastest-growing areas of care. We look forward to announcing the nation’s leading hospitals for outpatient care in 2024.

For more information on how Healthgrades rates hospitals, see our complete Healthgrades 2024 Specialty Excellence Methodology.

Consumers can also find a patient-friendly overview of our methodology here.

1 Consumer Insights Survey, Infosurv on behalf of Healthgrades, n=991, October 2022.

*Statistics are based on Healthgrades analysis of MedPAR data for the years 2020 through 2022 and represent three-year estimates for Medicare patients only.